Become A Member

To become a member, stop into any of our office locations or click here to begin the application process by completing our secure online membership application form. All applications are subject to approval and require a $25 membership share deposit in a savings account. Please note that members will need to sign an official account form in person at one of our offices before the account can be opened. For your own security, we’ll also need to photocopy a valid driver’s license or a state-issued ID.

To become a member, stop into any of our office locations or click here to begin the application process by completing our secure online membership application form. All applications are subject to approval and require a $25 membership share deposit in a savings account. Please note that members will need to sign an official account form in person at one of our offices before the account can be opened. For your own security, we’ll also need to photocopy a valid driver’s license or a state-issued ID.

Why Choose Citizens Community Credit Union?

Citizens Community Credit Union has been serving its members since 1940. Our motto is “Everything we do, we do for you” and we mean it! Our profits are returned to our members in the form of more and better services and more favorable rates on savings and loans. Citizens has consistently been ranked 5 stars annually for safety and security by Bauer Financial, Inc., an independent rating company.

Like all credit unions, we are a not-for-profit, member-owned, financial cooperative, and use our cooperative model to provide our members/owners with better rates on loans and deposits, as well as lower fees and charges. All credit union earnings are reinvested back into our credit union and used to better serve our member/owners.

Field of Membership

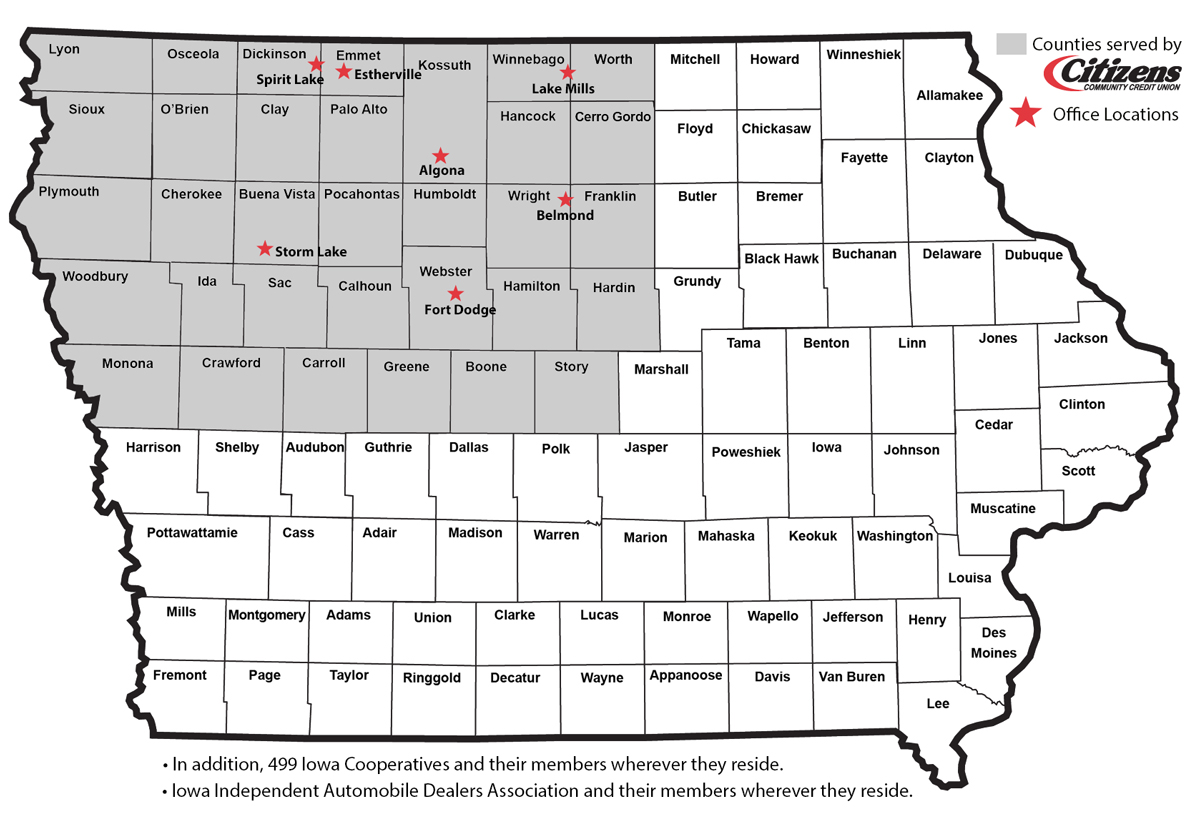

You may join Citizens Community Credit Union if you live, work, or have a close relative who lives or works in one of the following counties in Iowa: Boone, Buena Vista, Calhoun, Carroll, Cerro Gordo, Cherokee, Clay, Crawford, Dickinson, Emmet, Franklin, Greene, Hamilton, Hancock, Hardin, Humboldt, Ida, Kossuth, Lyon, Monona, O’Brien, Osceola, Palo Alto, Plymouth, Pocahontas, Sac, Sioux, Story, Webster, Winnebago, Woodbury, Worth, Wright.

Your Money Is Safe

The National Credit Union Administration (NCUA) is the federal agency that charters and supervises federal credit unions. The NCUA, like the FDIC, is backed with the full faith and credit of the U.S. Government.

The National Credit Union Administration (NCUA) is the federal agency that charters and supervises federal credit unions. The NCUA, like the FDIC, is backed with the full faith and credit of the U.S. Government.

Federally insured credit unions offer a safe place for you to save your money, with deposits insured up to at least $250,000 per individual depositor. The National Credit Union Administration (NCUA) is the independent agency that administers the NCUSIF. Like the FDIC’s Deposit Insurance Fund, the NCUSIF is a federal insurance fund backed by the full faith and credit of the United States government.